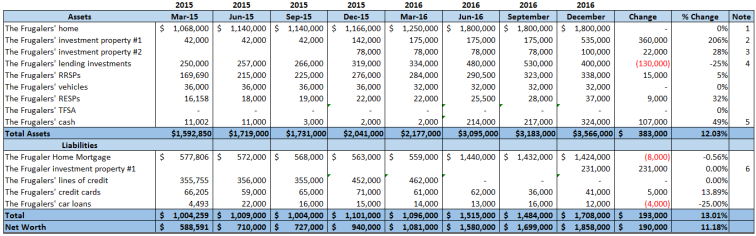

Wow, what an interesting 2016 it has been. Starting the year, our net worth was $940,000 and earlier that year, I had set a target of being a millionaire by the end of 2016 [Never underestimate the power of smart goals].

Fortunately, we were blessed in 2016 with a hot real estate market and I had a large amount of my assets tied up [personal home ($1.2 million), 2x pre-sale properties ($500k value), real estate lending with profit share ($300k), and RRSP investments ($300k)]. That represented $2.3 million in assets that took a ride upwards through 2016…And oh, what a ride it was. I would estimate that those assets returned between 40% and 50% over 12 – 16 months, or $900,000 – $1,150,000. As a result, we reached millionaire much sooner than expected (Q1 2016) and by the end of 2016 we are closing in on $2 million in net worth. While I am excited, I am still fearful of a downward movement and may accelerate an assignment of our second presale unit (we are now living in the first while our home is being built). Without further ado, here are the numbers:

Well, what happened?

- Nothing on the home front. While the market may be down, we have not seen anything to indicate we have lost value and our property tax assessment corroborated our purchase price.

- We closed on our first presale unit and had a lift of ~ $250,000 in the unit, which was much larger than I had anticipated. We have signed a home equity line of credit (HELOC) that will allow us to leverage that lift for an additional $195,000.

- We made another payment towards our eventual purchase.

- We received back principal on the investment. All that remains is our eventual profit, which is tracking to $400,000.

- We received the cash from #4 + $35,000 in the form of year-end bonus, after-tax.

- Our mortgage on the new property was $231,000 exclusive of the HELOC, which we have not drawn on.

I am feeling super blessed right now with where we are at in life and the journey we are on to financial independence. It is absolutely mind boggling to not only be a millionaire, but already being close to being a multi-millionaire. Was a lot of it luck? Was a lot of it the hot real estate market? Absolutely, 100%, I recognize that. It is why I feel blessed. But was part of it a grinding mentality? Absolutely, 100% again. While the market was hot…It’s not without saying that I had leveraged up with my wife in numerous ways to take advantage of a perceived heated market. What did we do? We scraped by, over and over, to access capital to purchase presale condo units in areas we felt would heat up dramatically. We took a contrarian approach to investing in one of the greatest single locations worldwide when the market felt it was not warranted. We stretched to put funds into investments instead of living a high life on the cash we had. All of that grinding and preparation allowed us to be “lucky”. Remember, as many people say “luck is what happens when preparation meets opportunity” 🙂

Now, onto something I have been thinking about lately, or for the last six months. The title of my blog says “Happy Frugaler”; unfortunately, I feel like the fraudulent frugaler. When I took on that tile, I was stressed, challenged, I didn’t know where life was going and I was seeking FI to free me from the tortuous treadmill of the corporate world. When I think frugaler, I think Mr. Money Mustache, Budgets are Sexy, Think Save Retire, to name a few. That isn’t really me. I am not very good with my $s. While I have improved, I am by no means frugal. While I recognize and will continue to get better, the debit side of the income statement is not where I have been, or see myself becoming, strongest. Instead, I am more in line with GenYFinanceGuy or the Financial Samurai. Yes, I can, and should, save more money; however, I want to live to a certain lifestyle that does cost more to maintain than $25,000, $50,000 or even $100,000 per year (though, I’d like to be lower with time). To that end, I continue to focus on how to make more money in the short, medium and long term and it is what I am going to continue writing about. Will the name change? Probably not, but don’t expect me to start writing about topics that are closer to the MMM lifestyle until I leave the corporate world behind and have sufficient net worth to afford my own version of frugality.

2017 SMART goal setting? Financially, nothing yet. We are building a house and will need all cash and debt available to us to do that. End result, I don’t perceive having very much available to invest and I cannot make money if I am not investing. If you asked me to pick a number that we are going to end 2017 at, I would suggest we will hit $2,100,000 in net worth. Not as great a movement as 2016 was, but a respectable 14% increase in net worth.

Congrats! That’s an awesome year!

When I read the first couple of lines, I thought you were going to say that you road the stock market up. It’s very impressive that you did this in real estate.

Hopefully 2017 is just as good 🙂

LikeLike

Thanks very much Kenneth!

I do not think 2017 will be as strong, but I have been wrong before. We will be building a new home in 2017 and most of our cash will be going towards the new build; hence, without the cash to invest I do not see us growing as quickly.

LikeLike

A 14% net worth increase is nothing to be ashamed of. That is quite good a good increase when the total net worth is high. Good on you.

LikeLiked by 1 person

Thanks Buy, Hold Long. Appreciate it isn’t bad. I’m targetting 20% to double in just under every four years.

LikeLike

Surprisingly, We hit the target (pretty close to), coming in at the end of the year at $2,090,000.

LikeLike

Congrats on your path is impressive considering the real estate market. I’m wondering if there are any tips you can give to first timers. I’m actually looking at purchasing land, in hopes that in the next 5 – 10 the investment might pay off, or at best, it can be passed down to the next of kin.

Any tips or suggestsions on that?

Cheers.

LikeLike

Thanks for your comment Ranga and this would actually make a really excellent post.

To boil it down simply for you, I’d use the words of someone I worked for previously, specifically “buy in the path of progress”.

Don’t buy where it is “hot” today. Buy where it will be hot tomorrow. While this may seem hard at first, there are ways to do it and they aren’t difficult, let me explain:

1. Have you ever seen a really desirable area and seen within a few blocks of it an area that wasn’t yet gentrified?

2. Did you go back years later and see that the area had been gentrified?

3. That’s the easiest way to do what I’m taking about.

While I make it sound simple, that’s because I think it is and have done it 4x now. We have bought homes in “up and coming” areas on multiple occasions. Each time, we were mere blocks from established areas and the up and coming areas had renderings that “fit” with the demographic of that area / generation.

Key things to consider, (a) Where is transit? Is it proximate to the area? (b) What surrounds this area? are there sufficient amenities? (c) Is there a “hot” area proximate to the location? Is that hot area less affordable than it was recently? Does it necessitate moving a few blocks away? If so, have you been able to identify that trend in advance of others?

If you can address (a) – (c), then you should be successful in beating the market. Good luck.

LikeLike