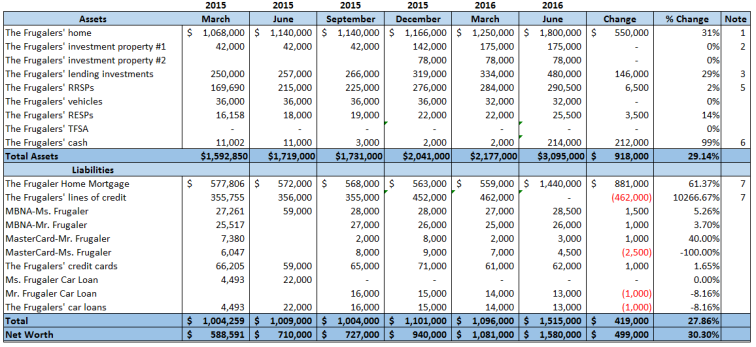

To say it has been a crazy year for our net worth would be an understatement:

In March we were excited to achieve the Million Dollar net worth level.

On May 21, 2016 I updated that we had sold our home for well above what we had been carrying it in our net worth, which resulted in our net worth increasing to ~ $1.525 million ($500,000 in two months???).

Where are we now? I think we have actually had bigger gains than I am going to show this round, because the real estate market continues to increase and we have two investment properties that I have not market up since December / March, despite the market being up ~20% the past six months. That said, the market can turn quickly and I have a perpetual fear now that the market will turn and the increases since we started tracking will fade away. Oh well, we will still live as we do, it won’t change our circumstances, per se. So, here it is:

How did we increase another $60,000 since the May update? Well, here you are:

- This is what we paid for our single family lot purchased this month.

- Based on current market prices proximate to our presale, a “book” gain of $100,000 is considered reasonable.

- Our lending investment was priority return + profit share. The profit share has outperformed. Total principal + interest and profit will be $675,000, which will be paid ~ 13 months from now. I am amortizing the gain over the remaining life of the loan.

- $25,000 was invested and the investments were marked to market.

- We sold our townhouse and purchased a single family lot we will build on. The cash will be contributed to construction costs.

- We paid off our HELOC and increased our mortgage to purchase a single family lot.

Two things that will move the needle over the next twelve months:

- As #3 indicates, we will receive significant profits on one of our real estate investments when it closes, which is expected to be in ~ 13 months. For perspective, this will add close to another $200,000 to our net worth within 12 months (note, When all is done, will be closer to $100,000 additionally after paying taxes).

- As I mention in the preceding paragraph, our investment properties have likely increased in value greater than I anticipated. We will be getting appraisals done when we close on them (pre-construction purchases) and I expect it to be at a higher value than I have included. We may decide to liquidate these investments to fund our home construction.

There you have it, it’s been an amazing and crazy quarter for my family and I don’t expect we will be slowing down our investing, saving, career growth so expect the numbers to climb, albeit slower than they have been.

To see graphically our growth in assets, liabilities, and net worth since we started tracking, see below:

What interests me in looking at this is when we started recording, our net worth was 59% of our total liabilities and the change by quarter has been an increase to 70%, 72%, 85%, 99% and finally 104%, implying our leverage has decreased over time and ideally that our risk has as well.

Until next time, Mr. Frugaler out.

That’s a LOT that you manage to do in one month. I mean 60k aside, I couldn’t imagine the amount of paperwork and errands that you need to do to settle all the estate changes. Would like to hear from you about productivity, something I been struggling with.

LikeLike

Thanks Lynn, it was a rough month as I was also averaging seven days per week at work at ~12 hours per day. It came down to good communication with my spouse and priorities, not to mention really long days.

LikeLike

Lynn, I should expand.

My wife is a very amazing and productive individual who is also a CA. She’s very organized and on top of things and helped to organize my life outside of work. During that roughly 40 day period, I didn’t take a single day off of work and still managed to get through it all, while having two young boys, because of the support and effort of Mrs. Frugaler. She truly is amazing.

LikeLike

Mr. HF, I admire your discipline to sell your home in the height of an real estate bull market. It’s very smart to take a large chunk of your profits and still keep your hands in the market with your investment homes. Congrats!!

LikeLike

Thanks Michael, unfortunately my wife wasn’t comfortable being out of market and we bought back in to single family.

Within one month our government introduced an additional tax on foreign buyers and the market is dropping / slowing.

I was right, but unable to effectively articulate my thoughts in a reasonable enough fashion to convince my wife. I don’t think we are down much because the person that bought our townhouse paid well above what I felt was market; however, we’d have benefited by waiting four months to buy.

LikeLike

Ahh, well at least you were able to benefit from those 4 months! 🙂

LikeLike