Read most of the Financial Independence Blogs and what is a common element time and time again? GOALS!

Almost every FI Blogger sets goals for themselves. Do they tell you how they do it? Do they give you a clear path to set your own goals?

Here, Mr. Money Mustache talks about the importance of proclaiming your goals publicly.

Here, J. Money talks about the importance of writing goals down.

The Simple Dollar talks about Financial Independence as a Goal itself!

I think we get it, goals are important and we should set goals for ourselves on our journey to financial independence, as well as in any other important areas of our life.

How do you set your goals? Do you pay attention to the Goal Setting Rules? Do you know what the Goal Setting Rules are?

Some consider the #1 rule is that your goals should be SMART goals:

Specific

Measurable

Attainable (Achievable)

Relevant

Time-bound

Walking your through how these goals work, I will then highlight my plan for the next two years, including assumptions and SMART Goals and illustrate how it should result in a December 31, 2016 Net Worth in excess of $1,000,000!

A great way to think about your SMART Goals is to ensure that you are able to answer the following questions with your Goals:

- Who,

- What,

- Where,

- Why,

- When, and

- How.

This is largely where the Specific comes in! You don’t want a goal of “I want to lose weight”, it’s not specific.

Instead, you may want to say “I will lose 10 pounds, by reducing my calories per day to 1,800 and exercising 4x per week” That is much more specific!

Next, you want your goal to be measurable. What’s an example of measurable and how it applies here? Let’s go back to I want to lose weight. How measurable is that? What counts as success? 1 pound? 2 pounds? Again, our modified goal defines three measures:

- Lose 10 pounds,

- Eat 1,800 calories per day, and

- Exercise 4x per week.

There are three specificly measurable aspects to this goal! I am going to work out 4x per week and I am going to eat 1,800 calories per day. Finally, I believe that if I do this, then I will lose 10 pounds!

While setting goals, one should stretch oneself to ensure growth and maturation; however, one should also ensure that the goal itself is either attainable or achievable (both start with A). By achieving your goals, you will be motivated to set more goals, more challenging goals and you will believe in your eventual success! It’s self-perpetuating.

How can you ensure success? One of the ways you can do this is by breaking down your goals into more manageable pieces that can be independently achieved and will culminate in meeting you’re ultimate goal. For example, setting a goal of losing 10 pounds without a plan might not be achievable. Setting a goal of reducing your calorie intake per day may be more attainable, but if it isn’t, them break it down further to focus on ways to get to 1,800. As well, exercising 4x per week should be attainable and will help drive the 10 pounds of weight loss.

What is an example of breaking down that 1,800 calories? Perhaps you would say, I am going to eat sub-500 calories for breakfast and lunch and I have researched 10 recipes that achieve that for each of those meals.

Ensure that the goals you are setting are relevant and will ensure you’re going to achieve your ultimate goal. Again, in our example you would have two goals (exercise and eating) that would both lead to the ultimate goal of 10 pounds of weight loss – perfect relevance!

Wait, I forgot, my goals wasn’t a SMART Goal because I didn’t have Time-Bound! I should have said “I will lose 10 pounds in 5 weeks by reducing my calories to 1,800 per day and by exercising 4x per week”. Now I would have a time-bound goal and my success would be determined at the end of 5 weeks!

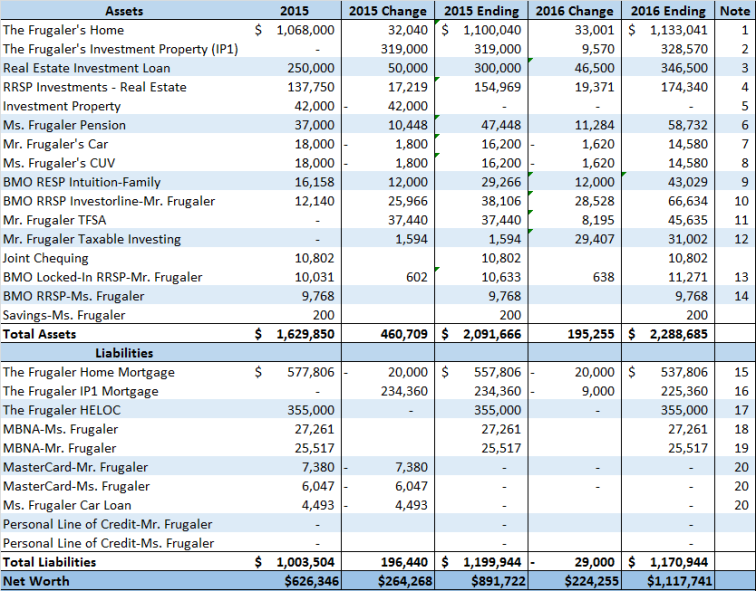

How am I going to use this, in conjunction with reasonable financial assumptions, to ensure that our net worth exceeds $1,000,000 by December 31, 2016? Well, take a look at the net worth projections below and let’s discuss the assumptions we used to build this and what SMART Goals are required!

Assumptions:

- Home values will increase 3% per annum, which is well below the Vancouver average of the past 15 years;

- Our investment property when we close on it will be valued at $40,000 higher than we paid (consistent with our research) and will grow at 3% per annum thereafter;

- The real estate investment loan is expected to generate a 20% IRR;

- The RRSP Investments – Real Estate are generating a combined average return of 12.5%, we are expecting this to continue;

- This is zero as it is included in our #2 now;

- We excluded Ms. Frugalers pension in our last net worth calculation. We have only included her portion above, not the matching portion, and assumed growth at her contribution rate (SMART GOAL 1) + 8% per annum return;

- We have assumed a declining balance of 10% per annum for the vehicles;

- See #7;

- We will invested $5,000 per child ($10,000 per annum) into RESPs (SMART GOAL 2), which will earn a 20% government match + 5% per annum;

- Between 10, 11, and 12, we will Invest $65,000 per annum (SMART GOAL 3), which will first fill up Mr. Frugalers RRSP, then catch-up TFSA, then start to invest in a taxable investment account. For these three investments, we have assumed a rate of return of 8% per annum;

- See #10;

- See #10;

- Assumed return of 6%;

- No assumed return – error, but can be a reserve for over-return assumptions above;

- Assume $20,000 principal reduction per year;

- Assume $9,000 principal reduction per year;

- HELOC outstanding until investments paid out;

- MBNA 0% cards outstanding at current balances;

- Credit cards paid off; and,

- Car loan paid off (September this year);

Looking at the above assumptions, it is key to note what is actually within our circle of control, because that is what drives our SMART Goals, everything else is simply a market based assumption, which will determine whether we are successful or not. It is also relevant to note that these assumptions, because they are not in our circle of control, should not stress us, drive our behaviors or determine our satisfaction with results. If we are able to achieve our SMART Goals and do not exceed $1,000,000 in two years, then that is fine, it was not meant to be and we could not control it 🙂

SMART GOAL 1: Ms. Frugaler contributes $7,200 to her pension per year and we assume that will continue;

SMART GOAL 2: Ms. Frugaler and I have fallen behind on the RESPs for our two boys. We are allowed to catch this up at $5,000 each for the next two years and will receive a matching government grant of 20% of the invested amount = $12,000 per annum for the two years.

SMART GOAL #3: This is the big one! If we are to succeed in our drive for $1,000,000 by December 31, 2016, then we will need to contribute a net amount of $65,000 per annum to a combination of RRSPs, TFSA and taxable investment accounts. This would be comprised of an initial contribution of $10,000 in year 1, $1,500 per month = $18,000 + 100% of bonuses, which we estimate to be $45,000. In the second year we would not have the initial contribution of $10,000. This will average to approximately $65,000 and ideally we can push it to $100,000 per year!!!!!

There you have it, we have made a number of assumptions, which we believe to be reasonable, and we have set ourselves 3 SMART Goals, which will contribute $85,000 per annum (includes RESP 20% match) per annum. We look forward to keeping everyone posted on it.

SMART goals are great. Plus putting them online for others to see will definitely give you the extra kick to make them happen (and maybe exceed them). Good luck!

LikeLike